Millennium Hotels & Resorts and Indian Hotels Company Limited (IHCL) have announced a strategic partnership that links their respective loyalty programmes, giving millions of members reciprocal access to hotels spanning four continents.

The agreement integrates Millennium’s MyMillennium programme with IHCL’s Taj InnerCircle, which operates under the broader NeuPass coalition loyalty scheme. Members of both programmes will receive a 10 per cent discount on the Best Flexible Rate at participating properties across the combined networks.

The partnership arrives as Millennium Hotels & Resorts marks its 30th anniversary. Founded in 1995 as a subsidiary of Singapore-listed City Developments Limited, the company has grown from its roots in South-East Asia to operate more than 145 hotels across Asia-Pacific, Europe, the United States and the Middle East.

For IHCL, the alliance represents another strategic move in its aggressive expansion. India’s largest hospitality company by market capitalisation operates 381 hotels with 134 under development across 14 countries. Its Taj InnerCircle programme reached 10 million members in March 2025, with loyalty-driven revenue now comprising over 40 per cent of the company’s total enterprise revenue.

The deal gives Taj InnerCircle members access to Millennium properties ranging from The Biltmore Los Angeles to Grand Copthorne Waterfront Hotel Singapore. MyMillennium members, in turn, gain booking privileges at Taj’s portfolio of palace hotels, city properties and resorts throughout India and beyond.

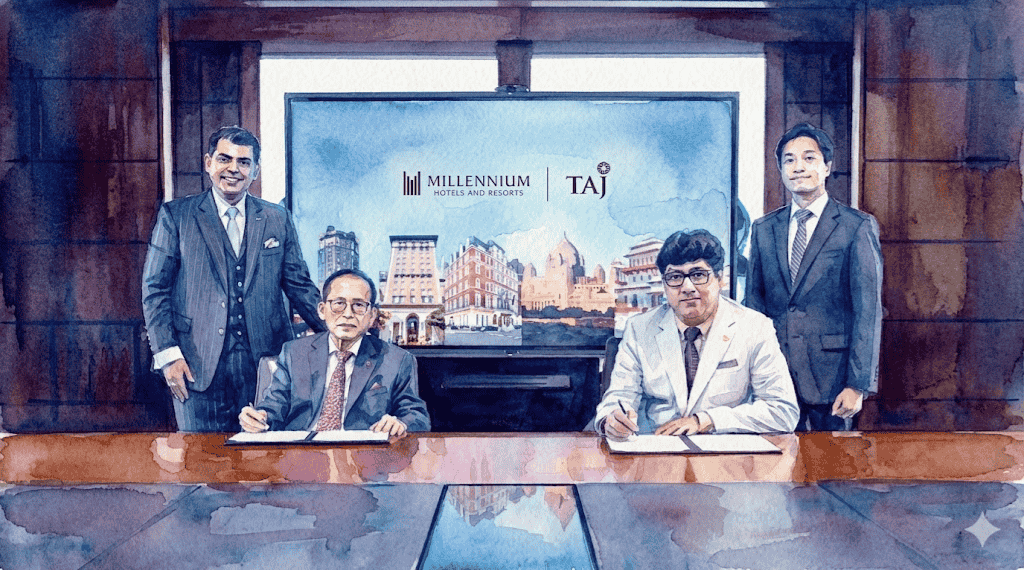

Puneet Chhatwal, IHCL’s Managing Director and Chief Executive Officer, framed the partnership as part of a broader strategy. The collaboration aims to extend reciprocal benefits across both portfolios while delivering value to guests and partners, according to the company’s announcement.

Kwek Leng Beng, Executive Chairman of Millennium Hotels & Resorts, positioned the alliance within the company’s expansion philosophy. The partnership combines Taj’s Indian hospitality heritage with Millennium’s international reach, the company stated, describing the approach as pursuing growth beyond traditional boundaries.

The timing reflects shifting dynamics in hotel loyalty programmes globally. Research from CBRE indicates that loyalty membership across major hotel brands reached 675 million in 2024, growing at more than twice the rate of new hotel construction. Average loyalty member contribution to occupancy rose to 52.8 per cent last year, underscoring the commercial importance of these programmes.

For Millennium, the partnership advances ambitions to scale to 500 hotels globally through strategic alliances. The company has invested in differentiating its member experience through technology, including AI-powered guest services, while achieving sustainability certifications across its Singapore and UK portfolios.

IHCL brings a distinctive competitive advantage through its integration with the Tata Group’s broader NeuPass ecosystem. The coalition loyalty programme allows members to earn and redeem NeuCoins across multiple Tata brands including retail, aviation and financial services – a capability that has driven the fivefold increase in IHCL’s loyalty membership base in recent years.

The partnership model differs from full programme mergers seen elsewhere in the industry. Rather than combining points currencies or status tiers, Millennium and IHCL have opted for a simpler reciprocal discount structure. This approach preserves each programme’s distinct identity while extending the practical benefits of membership.

Both companies are targeting growth in markets where the other holds established positions. Millennium gains stronger footing in India, a fast-growing hospitality market where IHCL commands premium positioning. IHCL extends its global accessibility through Millennium’s presence in gateway cities across Europe and the Americas.

The collaboration joins a broader trend of hotel groups seeking scale through partnerships rather than acquisition. Industry data shows that brand launches and loyalty alliances were primary drivers of membership growth in 2024, as companies look to broaden their appeal without the capital requirements of direct expansion.

Whether the 10 per cent discount structure delivers sufficient incentive to shift booking behaviour remains to be tested. Frequent travellers have grown accustomed to richer benefits from major global programmes, though the sheer breadth of the combined network may prove attractive for those seeking flexibility across diverse destinations.